Yesterday Jeff Macke launched a vicious attack on Robert Schiller and Marc Faber.

He doesn't like Schiller's CAPE ratio, because it shows that the US stock market is incredibly overvalued.

In fact the CAPE for the S&P 500 is higher now than it was in 2007 and has only been higher than it is now two other times in previous history.

Macke says CAPE has no predictive value.

He is wrong.

He is right that it means nothing about what will happen next week or next month or even the next six months, which are the time frames that momentum players trade.

Mebane Faber has done studies showing that investing when CAPE ratios are low will generate outsized returns for you while investing when they are high will cause you do have poor investment returns.

He has done study after study on this.

You can find a whole list of them here:

http://mebfaber.com/2014/08/22/everything-you-need-to-know-about-the-cape-ratio/

Macke does not like the CAPE because it says the US stock market bull market is overvalued and he believes that it is going to keep going up and he frankly wants it to do so.

In the world of someone who only invests in the US stock market and nothing else to the point they are obsessed and financially dependent on it the CAPE is something they do not like and do not want to hear about.

No bull wants to hear the stock market is overvalued.

They rather just hear slogans that the market is going to go up forever.

But instead of using the CAPE as a tool saying STOP they could use it as a tool to identify what markets are worth investing in.

They could use it to figure out what countries have cheaply valued stock markets that are worth buying into.

But most US stock market bulls are incapable of investing outside of the US stock market.

In reality they simply crave the action being all in one market gives them. It provides for them a pure gambling high.

Is Macke a bubble addict?

I do not know, because I do not know him.

I do know he is a fun video personality and has become the ideological leader of stock market bulls in this day and age, displacing James Cramer who is so 2007.

But I do know that many stock market bulls are indeed stock trading gambling addicts. That is why they believe the stock market will go up forever and nothing can stop it.

They literally need it to keep going up, because if it were to fall they would destroy themselves.

They are literally gambling their financial life on more stock market gains.

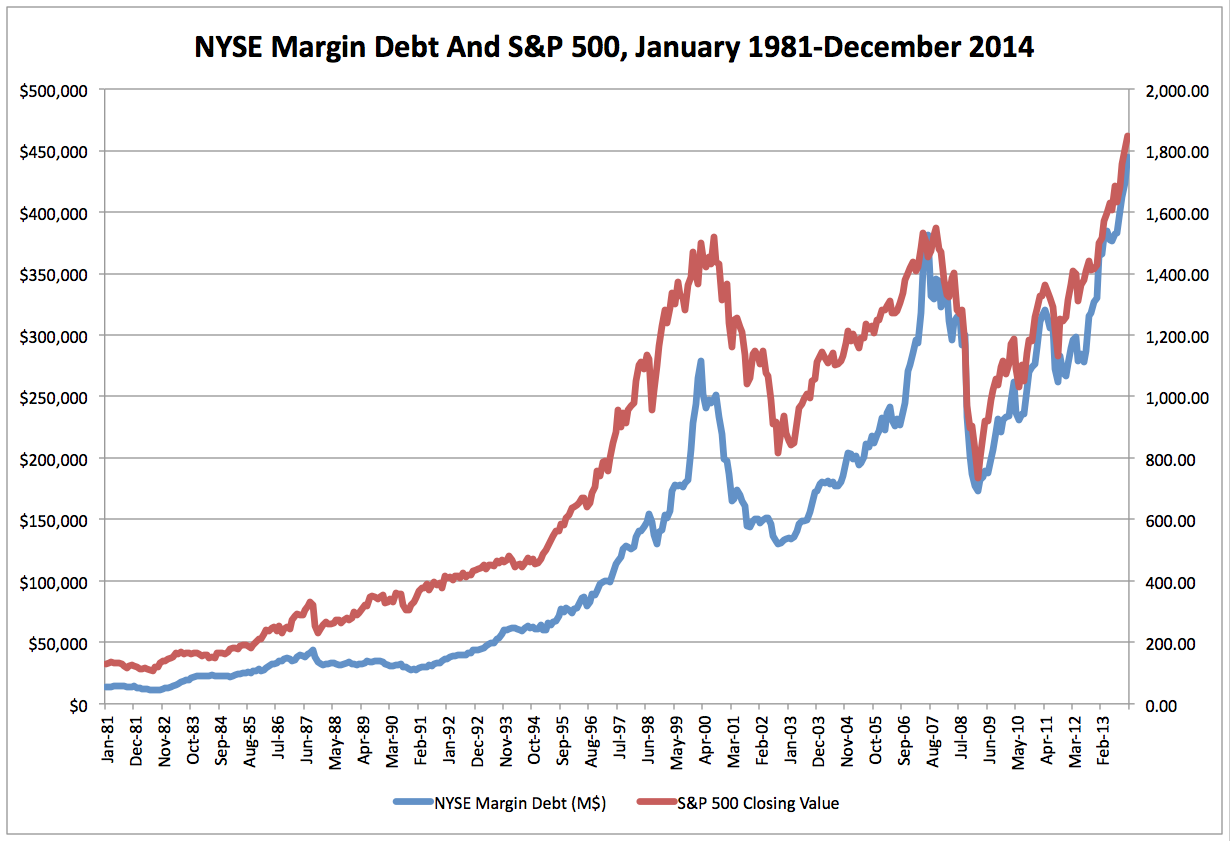

You may find it hard to believe that many of the bulls in the market now are pure gamblers, but consider this chart of margin debt:

I also know that when you invest in multiple markets and asset classes it is much easier to be objective on things, easier to control your risk, and easier to actually invest in places that are cheap.

And just about every year there is a new bull market and/or cheap market opportunity to invest in somewhere.

You cannot do that though if all you do is put all of your eggs in the US stock market bubble basket.

Real investing is about buying things at a good valuation that makes sense. It is not about chasing things just because they go up in price.

Money can be made doing that. That is called momentum playing. But it has nothing to do with investing.

I do not think of Macke as an investor, but as a momentum player. He was a star on "Fast Money" and the title of that show says what it was all about. He is doing well in the US markets now I am sure as they are going up, but the people watching him need to know the difference between momentum riding and investing and not confuse the two, because it so easy for people just starting out in the stock market game to fool themselves into thinking that they are investing when they are not.